Explore web search results related to this domain and discover relevant information.

Court appearance: New Orleans Mayor LaToya Cantrell is scheduled to appear in federal court Wednesday for the first time since being indicted on corruption charges. She is expected to enter a plea in response to conspiracy, fraud and obstruction charges in what prosecutors described as a yearslong ...

Dropping: U.S. mortgage rates dropped to their lowest in nearly a year, driving a jump in refinancing and buyer interest. The 30-year rate fell 15 basis points to 6.49% for the week ended Sept. 5, while 15-year and five-year adjustable rates also hit one-year lows.Court appearance: New Orleans Mayor LaToya Cantrell is scheduled to appear in federal court Wednesday for the first time since being indicted on corruption charges. She is expected to enter a plea in response to conspiracy, fraud and obstruction charges in what prosecutors described as a yearslong scheme to conceal an affair with her bodyguard […]

Mortgage rates are at 6.29% today following the PPI inflation report. The report, which was expected to show inflation of 3.3%, came in significantly lower at 2.6%. This led to a slight decrease in bond yields. Still, mortgage pricing has remained at the same 6.29% level as yesterday, according ...

Mortgage rates are at 6.29% today following the PPI inflation report. The report, which was expected to show inflation of 3.3%, came in significantly lower at 2.6%. This led to a slight decrease in bond yields. Still, mortgage pricing has remained at the same 6.29% level as yesterday, according to Mortgage News Daily.Analyzing purchase application data is the quickest way to determine if lower mortgage rates are having an impact.After 2022, I’ve noticed that housing demand improves when mortgage rates drop below 6.64% and move towards 6%. We observed this trend twice: in late 2022 and around the middle of last year, each time leading to over 12 weeks of positive data before rates increased again.Five out of the last six weeks have shown positive week-to-week results, which complements the positive year-over-year data showing double-digit growth every week. Now, we just need 12-14 weeks of this to make this the third time since late 2022 that the demand data picks up at this level of mortgage rates.

Right now, the best CD rate is 4.60% APY. Compare the best CD rates today, drawn from our research on about 280 banks and credit unions that offer CDs nationwide.

She is currently a full-time staff writer at Investopedia and one of the country's top experts on how to earn as much as possible on the money you hold in the bank. Before joining Investopedia, Sabrina wrote for Bankrate.com, CreditCards.com, DepositAccounts.com, and RateSeeker.Certificates of deposit (CDs) are fixed-interest accounts where you can deposit your money and then withdraw it later. Since 2019, we've been tracking the CD rates of more than 200 nationally available banks and credit unions every weekday, putting the results in our daily ranking of the highest CD yields across the major terms.The best CD rate right now is 4.60% APY, available from Connexus Credit Union for a 7-month term. All CDs and rates in our rankings were collected, verified, and available to open as of Sept.Below are the top CD and annuity rates available from our partners, followed by the best CD rates that we've found from our research that are available to U.S.

Buy discount newspaper subscriptions online and save on home delivery. At News Rates, you always get the best newspaper subscription deals, discounts and coupons.

Huge Savings on Popular Newspapers.

One mortgage lender's "sale" may not be the best deal. Always compare offers from multiple lenders.

In August, Chase Home Lending offered a flash "mortgage rate sale," offering up to a quarter-point (or 0.25 percentage points) off interest rates for mortgage purchase applications. The sale lasted 10 days – so prospective buyers had to act fast. Then on Sept.For what it's worth, based on the latest Home Mortgage Disclosure Act data, Chase customers have paid somewhat below-average origination fees compared with other lenders that U.S. News analyzes. So, that could bode well if you're able to get a low mortgage rate from Chase – but you won't really know if you're getting a good deal until you compare the full loan estimate from Chase with those from other lenders.Shopping for a mortgage can be intimidating, but it pays off. Research from Freddie Mac shows that buyers with mortgages of $250,000 to $350,000 can save about $600 a year by getting two rate quotes and $1,200 each year if they get four rate quotes.Mortgage lenders set the interest rates they charge, so a "sale" really depends on how the lender decides to price the loan.

The 30-year fixed is still 20 basis points higher than it was a year ago, but it is considerably lower than where it was at the start of last year, as well as in May, at the height of the spring homebuying season. For recent buyers, today's rates could offer some savings.

Search quotes, news & videos · Livestream · Watchlist · SIGN IN · Markets · Business · Investing · Tech · Politics · Video · Watchlist · Investing Club · PRO · Livestream · Menu · Real Estate · Published Wed, Sep 10 20257:00 AM EDTUpdated Wed, Sep 10 20258:12 AM EDT · Diana Olick@in/dianaolick@DianaOlickCNBC@DianaOlickWATCH LIVE · Key Points · The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances, $806,500 or less, decreased to 6.49% from 6.64% Applications to refinance a home loan jumped 12% for the week and were 34% higher than the same week one year ago.The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances, $806,500 or less, decreased to 6.49% from 6.64%, with points falling to 0.56 from 0.59, including the origination fee, for loans with a 20% down payment.The 30-year fixed is still 20 basis points higher than it was a year ago, but it is considerably lower than where it was at the start of last year, as well as in May, at the height of the spring homebuying season. For recent buyers, today's rates could offer some savings.A sharp drop in mortgage interest rates finally got some homebuyers off the fence.

WIDGETS Mortgage Rates Widgets Mortgage Calculator Widgets ... The Mortgage News Daily rate index is published daily (weekdays) around 4PM EST.

In addition to our own daily rate index, we also track surveys from Freddie Mac and MBA. More Detail and Charts: Mortgage News Daily | Freddie Mac | MBARATE SURVEYS Mortgage News Daily Freddie Mac | MBA | FHFAView today's current mortgage rates with our national average index, calculated daily to bring you the most accurate data when purchasing or refinancing your home. Follow our daily market analysis with Mortgage Rate Watch and we'll tell you where and why rates are moving.Search for Mortgage News Daily in the Apple or Google app store.

The report, produced by the Bureau of Labor Statistics, will be published one day ahead of the Consumer Price Index (CPI) data for the same month for Thursday. Producer inflation in the US is expected to rise at an annual rate of 3.3% in August, following a similar reading in July.

NEWS | 09/10/2025 09:25:12 GMT | By FXStreet Insights Team · Yesterday, when reports emerged that the Bank of Japan is still considering raising interest rates this year, I experienced a slight sense of déjà vu, Commerzbank's FX analyst Michael Pfister notes.Our Japan experts have long anticipated the next step (to 0.75%) at either the December or January meeting. Secondly, we may see more such announcements in the coming weeks in preparation for an interest rate hike. The yen may therefore face volatile times ahead." Share: Feed news ·GBP/USD pair trades with a mild positive bias in the European session on Wednesday. Traders ramp up their bets on aggressive Fed rate cuts, keeping the sentiment around the US Dollar undermined. However, renewed geopolitical tensions could weigh on the risk-sensitive Pound Sterling.The report, produced by the Bureau of Labor Statistics, will be published one day ahead of the Consumer Price Index (CPI) data for the same month for Thursday. Producer inflation in the US is expected to rise at an annual rate of 3.3% in August, following a similar reading in July.

Markets are nearly certain the Fed will cut interest rates after weak jobs data, but some strategists warn that looser monetary policy could bring new risks for stocks.

After a weak August jobs report, markets are nearly certain the Federal Reserve will cut interest rates by 25 basis points at its policy meeting next week, with some investors even betting on a larger reduction.Yardeni argued that with productivity improving and the unemployment rate still historically low, extra liquidity risks fueling a speculative rally driven by investor FOMO rather than fundamentals — the kind of rally, he warned, that often ends in a sharp correction.Stuart Kaiser, head of US equity trading strategy at Citi, called August's weak payrolls report a "negative growth signal" that is "more powerful than the benefit of rate cuts being priced in." Put simply, if hiring continues to slow and unemployment drifts higher, the drag on earnings and economic growth will matter more for equities than the short-term lift from easing monetary policy.Federal Reserve Chair Jerome Powell gestures during a press conference following the issuance of the Federal Open Market Committee's statement on interest rate policy in Washington, D.C., on July 30. (Reuters/Jonathan Ernst/File Photo) ·

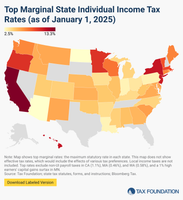

Explore the latest 2025 state income tax rates and brackets. See states with no income tax and compare income tax by state.

Of those states taxing wages, 14 have single-rate tax structures, with one rate applying to all taxable income. Conversely, 27 states and the District of Columbia levy graduated-rate income taxes, with the number of brackets varying widely by state. Currently, six states—Arkansas, Kansas, Massachusetts, Montana, North Dakota, and Ohio—have a two-bracket income tax system.In some states, a large number of brackets are clustered within a narrow income band. For example, Virginia’s taxpayers reach the state’s fourth and highest bracket at $17,000 in taxable income. In other states, the top rate kicks in at a much higher level of marginal income.A marriage penalty typically occurs when two individuals with similar incomes marry; this is true for both high- and low-income couples..” Some states index tax bracketsA tax bracket is the range of incomes taxed at given rates, which typically differ depending on filing status.In the following tables, we have compiled the most up-to-date data available on state individual income tax rates, brackets, standard deductions, and personal exemptions for both single and joint filers. Following the tables, we document notable individual income tax changes implemented in 2025.

By the authority vested in me as President by the Constitution and the laws of the United States of America, including the International Emergency

I have received additional information and recommendations from various senior officials on, among other things, the continued lack of reciprocity in our bilateral trade relationships and the impact of foreign trading partners’ disparate tariff rates and non-tariff barriers on U.S.After considering the information and recommendations that I have recently received, among other things, I have determined that it is necessary and appropriate to deal with the national emergency declared in Executive Order 14257 by imposing additional ad valorem duties on goods of certain trading partners at the rates set forth in Annex I to this order, subject to all applicable exceptions set forth in Executive Order 14257, as amended, in lieu of the additional ad valorem duties previously imposed on goods of such trading partners in Executive Order 14257, as amended.For a good of the European Union with a Column 1 Duty Rate that is less than 15 percent, the sum of its Column 1 Duty Rate and the additional ad valorem rate of duty pursuant to this order shall be 15 percent.Upon the effective date of the modifications provided in Annex II to this order, to facilitate implementation of the rates of duty provided in Annex I to this order, headings 9903.01.43 through 9903.01.62 and 9903.01.64 through 9903.01.76, which are organized by rate of duty, and subdivisions (v)(xiii) (1)-(9) and (11)-(57) of U.S.

October 3rd is a date that has ... mortgage rate coverage. That's because there's been a veritable chasm between t... ... Mortgage applications decreased modestly last week, with overall volume slipping 1.2%. The Mortgage Bankers Association’s weekly survey showed a decli... ... NEW Processing, AML, Prospecting Tools; Pennymac's Non-QM News; LOs and Database ...

October 3rd is a date that has come up many times in the past month of mortgage rate coverage. That's because there's been a veritable chasm between t... ... Mortgage applications decreased modestly last week, with overall volume slipping 1.2%. The Mortgage Bankers Association’s weekly survey showed a decli... ... NEW Processing, AML, Prospecting Tools; Pennymac's Non-QM News; LOs and Database Importance - Rob Chrisman - Wed, 11:40 AMMortgage rates are based on bonds and bonds can do funny things on the first and last trading days of any given month. One of the most common "funny t... ... NEW Loss Mit, Data Mining, Pre-Approval Letter Tools; jumbo, HELOC, Non-Agency News; Watch Those Student Loans - Rob Chrisman - Tue, 11:37 AMIt continues to be the case that day-to-day changes in average mortgage rates are very small. Today was no exception in that regard. Nonetheless, toda... ... NEW Light Data Calendar Leaves Focus on Treasury Auctions. Do Earning Matter? - MBS Commentary - Wed, 11:18 AM ... Not that this week's economic calendar is especially robust, but Wednesday's offerings are especially light. There are no monthly economic reports on ... ... NEW Cost to Originate; Automatic Lender, Custom Software; Disaster News; Mr.NEW Powell Appears to Signal Rate Cuts Due to Evolving Circumstances Eye on Housing - Fri, 1:17 PM · NEW Single-Family Home Size: 2Q25 Data Eye on Housing - Fri, 12:55 PM · NEW Q3 GDP Tracking Calculated Risk Blog - Fri, 12:24 PM · NEW Monetary Policy and the Fed’s Framework Review Chair Jerome H. Powell Federal Reserve - Fri, 10:05 AM · NEW Homebuyers have lost thousands of dollars in spending power since 2019here's how much CNBC - Thu, 12:02 PM · NEW Newsletter: NAR: Existing-Home Sales Increased to 4.01 million SAAR in July; Up 0.8% YoY Calculated Risk Blog - Thu, 10:50 AM

In support of its goals, the Committee decided to maintain the target range for the federal funds rate at 4-1/4 to 4-1/2 percent.

News & Events · Press Releases · PDF · July 30, 2025 · For release at 2:00 p.m. EDT · Share · Although swings in net exports continue to affect the data, recent indicators suggest that growth of economic activity moderated in the first half of the year. The unemployment rate remains low, and labor market conditions remain solid.In considering the extent and timing of additional adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks. The Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage‑backed securities.The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. Uncertainty about the economic outlook remains elevated.In support of its goals, the Committee decided to maintain the target range for the federal funds rate at 4-1/4 to 4-1/2 percent.

30-Year Fixed Refinance Rate dips! Is it time to refinance your mortgage? Learn about current rates, the Fed's influence, and key factors to consider. Updated: Sept 10, 2025.

If you're thinking about refinancing your home, here's the update: According to Zillow, the national average 30-year fixed refinance rate is currently at 6.71% as of September 10, 2025. Good news: that's down 4 basis points from last week! This slight dip offers a glimmer of hope for homeowners looking to lower their monthly payments or tap into their home equity.While the decrease in the 30-year fixed rate is welcome, it's essential to note that the other rates have increased. I think this highlights the volatility we're seeing in the market and emphasizes the need to stay informed.For homeowners with existing mortgages, understanding these fluctuations is crucial. A drop in the 30-year fixed refinance rate, like the one we're seeing today, can be a signal to explore your refinancing options. I feel this is especially true if your current mortgage rate is significantly higher than today's average.It's crucial to monitor the financial markets to fully understand the situation. Here's a snapshot of the latest refinance rates as of today:

Some stablecoins offer up to 5% on deposits on certain crypto platforms, a far more attractive rate than the US national average savings rate of just 0.6% and still above the best offered high-interest rate of 4%, according to Bankrate data.

News · Indices · In Depth · Learn · Crypto Bonus · Podcasts · Anti-Scam · About · Martin Young · 8 hours ago · Bitwise investment chief Matthew Hougan says banks should pay their customers higher interest rates if they’re worried about competition from stablecoins.Some stablecoins offer up to 5% on deposits on certain crypto platforms, a far more attractive rate than the US national average savings rate of just 0.6% and still above the best offered high-interest rate of 4%, according to Bankrate data.The highest-yielding US bank accounts offer a lower interest rate compared to most stablecoins.

A sharp drop in mortgage rates to the lowest level since last year caused a spike in mortgage demand.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances, $806,500 or less, decreased to 6.49% from 6.64%, with points falling to 0.56 from 0.59, including the origination fee, for loans with a 20% down payment.The 30-year fixed is still 20 basis points higher than it was a year ago, but it is considerably lower than where it was at the start of last year, as well as in May, at the height of the spring homebuying season. For recent buyers, today's rates could offer some savings.A sharp drop in mortgage interest rates finally got some homebuyers off the fence.Mortgage rates inched up very slightly to start this week, but could move more decisively later in the week.

House Price News · Specialist ... · MS Wired · Events · Webinars · Leah Milner 10 September 2025 9:51 am · Buy-to-let fixed rates fell to their lowest level for three years this month and product choice reached a record high, figures from Moneyfacts show....

House Price News · Specialist · Equity Release · Second charge · Short term loan · Commercial · Buy to let · Regulation · Tax · Politics · Lenders · Lending Strategy · Products · Digital Edition · Supplements · Special Reports · Industry Insight · Podcast/Video · Podcast · Video · MS Wired · Events · Webinars · Leah Milner 10 September 2025 9:51 am · Buy-to-let fixed rates fell to their lowest level for three years this month and product choice reached a record high, figures from Moneyfacts show.“However, successive governments have placed pressure on many other areas of a landlords’ finances for decades and with the news of yet another blow for investors due in the upcoming Budget, the future of the private rented sector is concerning.The average two-year fixed rate for landlords dropped to 4.88% in September, down from 4.91% in August and from 5.35% a year ago.The average five-year rate fell to 5.21% from 5.23% last month and from 5.33% a year ago.

Georgia is among the countries with the highest mortgage interest rates, according to data collected by GlobalPropertyGuide. Compared to global benchmarks, Georgia’s rates are elevated—higher than in advanced economies (e.g., U.S. ~6.4%, Eurozone ~3-4%) but lower than regional peers like ...

Georgia is among the countries with the highest mortgage interest rates, according to data collected by GlobalPropertyGuide. Compared to global benchmarks, Georgia’s rates are elevated—higher than in advanced economies (e.g., U.S. ~6.4%, Eurozone ~3-4%) but lower than regional peers like Turkey (~44%) or Russia (20-25%). Within emerging markets, it’s on the higher end, similar to […]Recent Movements: Rates have shown a slight downward trend in 2025, declining from 13.15% in prior periods to 13.12% by June. This follows a broader stabilization after peaks in 2022-2023 driven by post-pandemic inflation and the Russia-Ukraine conflict’s spillover effects.Historical Context: From 2008-2025, the policy rate averaged 7.25%, with highs of 12% in 2008 amid global financial crisis impacts. Mortgage rates have followed suit, trending downward from double-digit highs in the early 2010s as banking reforms improved.High rates are common in emerging markets with double-digit inflation or currency instability. For instance, Turkey’s rate of 44% is the global outlier, far exceeding even other high-inflation nations, as banks price in massive risk premiums.

OLYMPIA, Wash. – Washingtonians using the state's Exchange for individual health insurance will see an average rate increase of 21% in 2026. The Washington Health Benefit Exchange Board will review

Average Pet Insurance Rates as of September 2025 | Insurify ... Your notification has been saved. There was a problem saving your notification. ... Email notifications are only sent once a day, and only if there are new matching items. ... Success! An email has been sent to with a link to confirm list signup. Error! There was an error processing your request. Get Tri-Cities Breaking News alerts from NBC Right Now.The Washington Health Benefit Exchange Board will review the approved plans and rates on Thursday, September 11.Insurers have cited various factors for the rate increase, including the potential expiration of tax credits, rising costs, and increased service usage.A daily newsletter focused on providing important and timely news for Yakima and surrounding communities.

The Federal Reserve is widely expected to cut interest rates next week even though inflation is still around 3%, a full percentage point above the official goal. This raises an uncomfortable question: is the central bank's 2% inflation target still viable?

ORLANDO, Florida, Sept 9 (Reuters) - The Federal Reserve is widely expected to cut interest rates next week even though inflation is still around 3%, a full percentage point above the official goal.Of course, the Fed cut rates late last year when core CPI was even higher at around 3.3%, though that move drew fire because unemployment didn't rise as Fed officials had warned and long-dated yields rose.A 3% inflation print on Thursday followed by a rate cut next week might suggest we are heading in that direction.The dollar has been beaten down this year as investors have priced in a resumption of the Federal Reserve's rate-cutting cycle.